Double materiality – a strategy tool valuable for uncertain times

Are you seeking to understand double materiality, struggling with its execution, or wondering what it means for your organization? Let us delve into how we can make it a valuable tool for innovation and strategic discussions, across the management team and the organization.

If you work in any of the approximately 50,000 companies in Europe, including more than 2000 Norwegian companies, that are subject to the EU's Corporate Sustainability Reporting Directive (CSRD) or have these companies as your key customers, delving into double materiality could be a wise move.

What is a double materiality analysis?

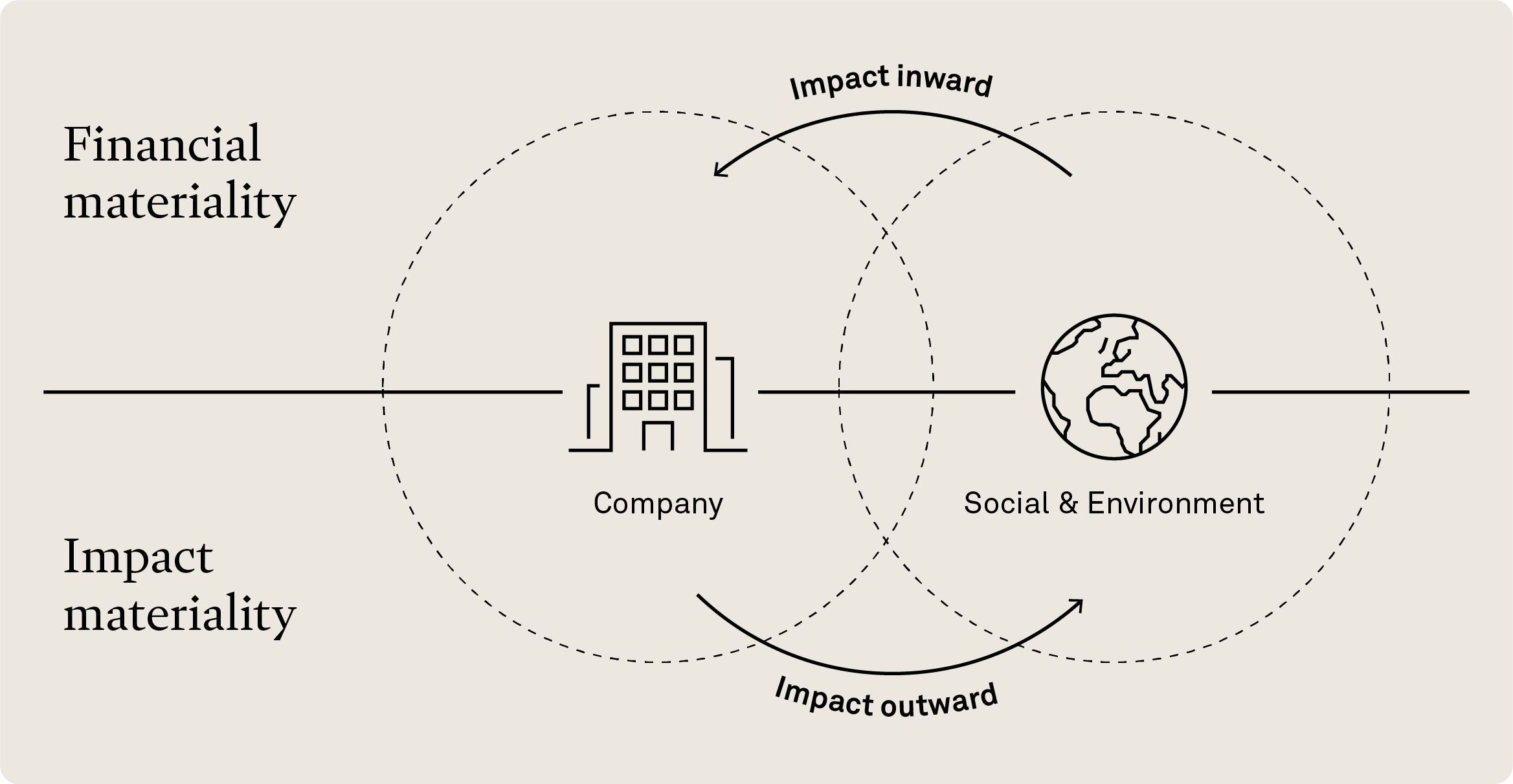

In a nutshell, double materiality analysis, in line with CSRD, involves assessing a company's impact in two dimensions:

Financial impacts on the company are termed financial materiality or impacts inward, while the company's influence on the surroundings and the broader external environment is termed environmental and social materiality or impacts outward.

CSRD mandates reporting on both dimensions, requiring companies to disclose information on environmental, social, and governance (ESG) aspects relevant to stakeholders. It also encourages the consideration of how external sustainability factors may affect a company's financial performance, prompting the disclosure of related risks and opportunities.

While CSRD is the directive that set out the requirements for corporate sustainability reporting, the European Sustainability Reporting Standard (ESRS) comprises of 12 standards that structure the disclosures: Two so called cross-cutting standards, which apply to all sustainability matters, and 10 topical standards, covering a wide range of environmental, social and governance matters: Climate change, pollution, resource use and circular economy, workforce, affected communities, consumers, end-users and business conduct to mention some of them.

Materiality might be viewed as a technical checklist exercise, but the real purpose of a materiality analysis is to align business strategy with Environmental, Social, and Governance (ESG) priorities. As companies are obligated to do a double materiality analysis, they should assure they get the most value from it: In ÆRA, we believe that the double materiality work, with the right approach, can create significant value throughout the organization and in developing and detailing corporate strategy, especially in the times we are currently in. Here are a few reasons why.

1. A broader view on strategic impact!

Traditionally, some companies have prioritized ESG issues based on existing strengths, competitive advantages, or immediate financial impact. Double materiality transforms this into a broader strategic effort, aiming to identify areas where influence is substantial and where genuine impact can be made within a broader systemic context: In simple terms, double materiality shifts the focus from mirroring what is suitable or perceived as important to the company, to focus on companies’ actual impact on society and the environment.

One question that often arises working with double materiality is thus: How do I know which areas are most material to my business in terms of impact? The three following keywords can help guide this assessment:

Scale: The magnitude of impact on financials and the external environment

Scope: The extent and reach of the impact

Remediability: The corrective measures needed to address the impact

Understanding your company's ESG impacts uncovers additional risks and opportunities, prompting adjustments that may lead to changes in strategy, operational processes, or even adopting a new business model.

It also helps you navigate uncertain times by giving a broader perspective on your business and its context. In developing an opinion about the future to help navigating a changing landscape, this is crucial.

Double materiality assessments should be valued by its outcome for the organization and how it informs strategy and business development, not by the fact that it is completed for reporting.

2. Stakeholder Engagement for collaboration and value creation

While people often think double materiality analysis is the work of the sustainability team, it actually involves a multi-stakeholder consultation. This consultation should include individuals or teams with subject matter expertise that all together cover a full range of sustainability and financial materiality matters and perspectives.

As the double materiality expands how financial decisions are made and is crucial for updating investors about environmental, social, and governance (ESG) matters alongside traditional financial updates, CFO´s and financial departments are key stakeholders. Investors will increasingly seek to understand the likelihood, and magnitude, of material ESG issues impacting companies´ competitive positions and ability to create value. In addition to finance, internal colleagues, C-suite, board members, and the audit committee are also crucial to get along.

Externally, it is important to include suppliers and stakeholders affected by the company's activities. Building strong connections throughout the value chain is a big part of this.

Even though companies used different methods for materiality assessments, CSRD is pushing for consistency. If done well, this process is a great opportunity to gather useful information, form strategic partnerships, understand essential business practices, and find opportunities for collaboration within the industry or along the entire value chain.

3. Corporate governance as a guide in uncertain times

Adhering to the guidelines set by the EU and EFRAG is a must. An integral part of this analysis involves implementing a testing phase to validate ESG issues. External ESG expertise and the validation of external data, such as trends data, impact data, industry ESG signals, and other guidance (e.g., GRI and SASB) contribute to a comprehensive evaluation. The ability to navigate effectively is critical for informing future strategic decisions.

The scope defined by ESRS sets a framework for structuring and integrating these topics in organizational processes. This is, for one, an aid in navigating a landscape with and abundance of information. Maybe more importantly, it can be an aid in structure discussions on other topics where we do not yet understand the full consequences of – be it technology, supply chain disruptions or a difficult to read macro-economic picture.

Corporate sustainability and ESG reporting practices are still evolving, presenting challenges such as potential reliance on perception-based results, difficulties in applicability to competitive scenarios, and confusion in selecting guidelines and frameworks. Risks such as data manipulation, problems with weighting, lack of objectivity, and the absence of a holistic all-business approach to analysis underscore the need for careful consideration in this emerging domain.

Governance processes playing a central role in monitoring and addressing material impacts, risks, and opportunities that could pose threats to today’s business and operating model. As such, it is high time for you to initiate work to integrate double materiality as a valuable tool for strategic discussions in corporate governance.

Does this sound interesting to you?

Want to dive deeper into the opportunities of double materiality? Contact Hanna or Idunn below, and stay tuned to our ÆRA updates to follow what is going on in this space.

Idunn Hals Bjelland-de Garcia

Partner, Executive Advisor & Director of Corporate Impact